- SUPERVISORY RESPONSE FRAMEWORK: World Bank – Review and evaluation of the existing SRF for the National Bank of Tajikistan (June 2019).

- SUPERVISORY LIQUIDITY CONTINGENCY PLAN: World Bank – Global Practice: Draft for the National Bank of Tajikistan (April 2019).

- NON-PERFORMING LOAN RESOLUTION: World Bank - Document on cross country NPL resolution schemes for the National Bank of Tajikistan (March 2019).

- LIQUIDITY RISK REGULATORY FRAMEWORK DRAFTING: World Bank – TA for the National Bank of Tajikistan (2017).

- PILLAR II CAPITAL SELF-ASSESMENT. BRS Banque S.A. – Antigua & Barbuda (2017-19).

- BASEL II/III IMPLEMENTATION. IMF-CARTAC - TA for Eastern Caribbean Central Bank (2017 & 2018), Central Bank of Belize (2018), Central Bank of Barbados (2018), British Virgin Islands Financial Supervisory Committee (2019)

- CREDIT, LIQUIDITY and INTEREST RATE RISK SUPERVISION. Fit & Proper LLC external consultant for TA to SIBOIF, Nicaragua (2013).

- OPERATIONAL RISK. PRISMA S.A. Argentina – Standards for operational loss data reporting for an aggregate data consortia (July 2019).

- TREASURY MANAGEMENT. IMF-CAPTAC Program Leader in training courses for the Financial Institutions Superintendence of El Salvador and Banking Superintendence of Panama (2017) and Superintendence of Costa Rica (2018).

-RISK MANAGEMENT FRAMEWORK. EFECTIVO SI S.A. - Assessment for the design of its internal interest rate and operational risk management systems, Argentina (2018).

- STRESS TESTING. IMF-CARTAC Seminar Program Leader on Stress Testing for Credit Unions: Financial Services Regulatory Commission of Antigua & Barbuda (2018).

- ALM, STRESS TESTING and RISK CONTROL SELF-ASSESMENT. IMF-CARTAC Regional Workshop for Caribbean Association of Credit Union Supervisors in Barbados (2017).

- MARKET RISK and INTEREST RATE RISK in the BANKING BOOK. IMF-CAPTAC Regional Seminar Program Leader in Guatemala (August 2017).

- LIQUIDITY RISK, LCR & NSFR. IMF-CAPTAC Regional Seminar in Guatemala (2016).

- CREDIT RISK. Banco Nación Argentina Credit Risk Department: Training on models for credit risk economic capital estimation, Argentina (2016).

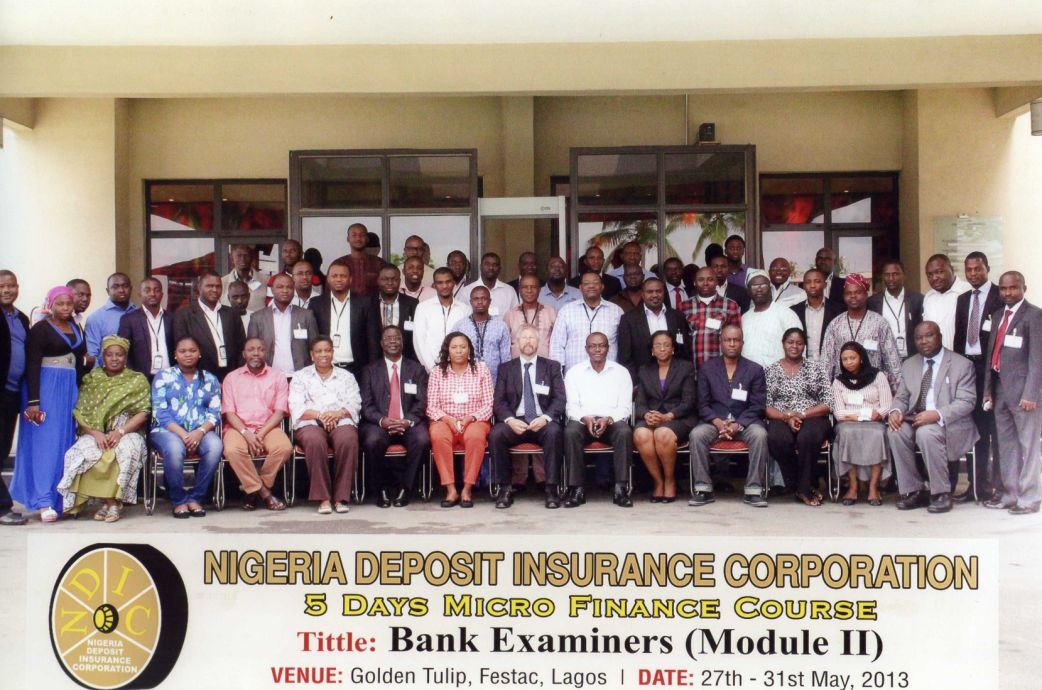

- MICROFINANCE. Frankfurt School of Finance and Management – Program Leader in the Course for Banking Supervisors on Regulation and Supervision of Microfinance Institutions, NDIC Nigeria (2013).

- MICROFINANCE. TORONTO CENTER – CGAP. Program Leader for the Regional Program

on the Supervision of Microfinance Institutions, Rwanda (2013).

- MARKET RISK AND INTEREST RATE RISK IN THE BANKING BOOK. IMF-CAPTAC-DR TA for drafting guidelines on market risk for the National Commission for Banks and Insurance Institutions in Honduras (Dec & Feb 2018).

- FINANCIAL INSTRUMENTS SUPERVISION. IMF-CAPTAC-DR - TA Superintendence of Banks and other financial Institutions in Nicaragua (May 2018).

- FINANCIAL DERIVATIVES SUPERVISION. TORONTO CENTER. Program Leader for training of SUGEF, SUGEVAL, BCCR y CONASSIF Supervisors, Costa Rica (2016).